Today is the day we release one of my two favorite pieces of thought leadership in the ERP software industry: the Clash of the Titans 2014 report. In this analysis, which we’ve published annually over the last several years, we look at actual implementation results from hundreds of Tier I ERP implementations across the globe to provide a quantitative and unbiased comparison of SAP vs. Oracle vs. Microsoft Dynamics. Our research provides the industry’s most credible and independent analysis of these three leading ERP systems and is invaluable to the large amount of organizations closely evaluating one or more of these three ERP titans.

This year’s report tells us a number of interesting things, especially when compared with previous years of research. For example, the data shows that SAP is selected more often than Oracle or Microsoft Dynamics products, while Oracle has the highest post-implementation success rate and Microsoft Dynamics has the shortest implementation duration. These are just three key findings in the extensive report, which integrates quantitative and qualitative data from our annual research of Tier I ERP implementations, as well as our team’s collective and extensive experience evaluating and implementing each of these ERP systems for our global client base.

In addition, here are a few other highlights and themes featured in the report:

Implementation durations and costs are increasingly hard to predict. As revealed in our 2013 ERP Report published this year – which analyzes all ERP implementations rather than just those of SAP, Oracle and Microsoft Dynamics – ERP implementations are rarely completed within the expected timeframe or budget or with the expected resources. These dynamics are particularly true for the three titans. Microsoft Dynamics implementations actually have the largest delta (nearly a 50% increase) between planned and actual implementation durations, with companies implementing in an average of 12.5 months compared to an expected duration of 8.5 months. In addition, Oracle implementations take roughly 25% longer than SAP implementations and are nearly double that of Microsoft Dynamics. Similarly, implementing organizations experience gaps between their actual and expected implementation costs, with the average Microsoft Dynamics implementation running 18% over budget, while SAP and Oracle see 13% and 4% deltas, respectively. Although these trends are common for all ERP vendors (rather than just for Tier I vendors), they are magnified by the number of organizations implementing one of these three solutions.

Operational disruptions are becoming the Achilles heel of Tier I ERP implementations. CIOs and CFOs commonly worry about implementation costs and duration but few have the foresight to consider the risk of material operational disruptions at the time of go-live. Based on data revealed in this report, however, they would be well-served to plan ahead to mitigate the post-implementation risk of material operational disruptions, such as not being able to ship product or close the books. Our data reveals that 69% of SAP implementations experience some level of material operational disruption, followed by 67% of Microsoft Dynamics implementations and 50% of Oracle implementations. Perhaps even more concerning, SAP and Oracle implementations both had a relatively high percentage of disruptions lasting more than one month, while Microsoft Dynamics had the lowest average disruption time. As discussed in the report, most of the factors leading to disruption have less to do with the technology itself and more to do with issues related to organizational change management and business process reengineering.

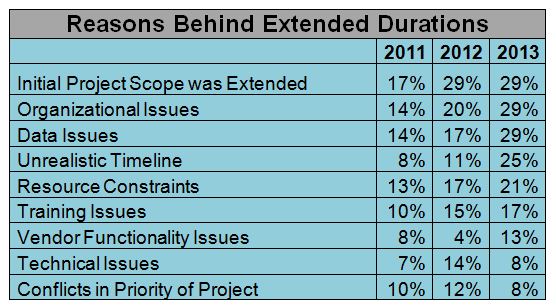

Implementation risk has little to do with the software. Although we make broad conclusions about “average” implementation results specific to each of the three titan ERP vendors, very little risk has anything to do with the functional and technical competencies of the software. In fact, over the last three years, our research has shown the biggest increases in risk factors such as organizational issues, data issues and unrealistic project timelines. Further, all but two of the implementation risk factors we track in our research have increased in recent years, while “technical issues” is tied for the lowest risk factor. This suggests that all the R&D and technical innovation in the world isn’t going to change the basic blocking and tackling required for successful ERP implementations, such as effectively managing organizational change, clearly defining and reengineering new business processes and rolling out effective end-user training programs for employees.

ERP success vs. failure is difficult to define. On the one hand, SAP, Oracle and Microsoft Dynamics implementations generally take longer than expected, cost more money than expected and create operational disruptions for a majority of organizations. On the other hand, end-state satisfaction levels aren’t as bad as you would think, given this bleak backdrop. For example, while the percentage of companies that had yet to recoup their ERP implementation costs spiked to nearly 40%, an overwhelming majority consider their implementations successful. More specifically, 71% of organizations implementing Oracle considered their projects successful, while the same can be said for 67% of those implementing Microsoft Dynamics and 62% of those implementing SAP. Clearly, this suggests that a) companies don’t have a clear definition of what exactly implementation success means, and/or b) organizations generally set very low standards for their ERP implementation results.

These are just a few of the themes and trends we see in the report. While our quantitative and qualitative research isn’t meant to provide all answers related to SAP, Oracle or Microsoft Dynamics, it is intended to provide an important data point during our clients’ ERP selection and implementation planning processes.

Learn more by registering for our Clash of the Titans webinar tomorrow and our Vendor Showdown webinar next month. Also, be sure to download our Clash of the Titans 2014 report.